25 Years of Legal Experience

Legal Advantage LLC’s founding partners are experienced attorneys with over 25 years of legal experience. Their vision was to form an organization that would become the partner of choice for law firms, corporations, and universities in need of world-class IP legal services. Legal Advantage LLC combines unparalleled dependability, accuracy, and client service, resulting in a stellar client retention rate among the highest in the industry.

Patent Search

Dedicated experts with extensive experience in multiple domains conduct comprehensive patent searches, delivering insightful results.

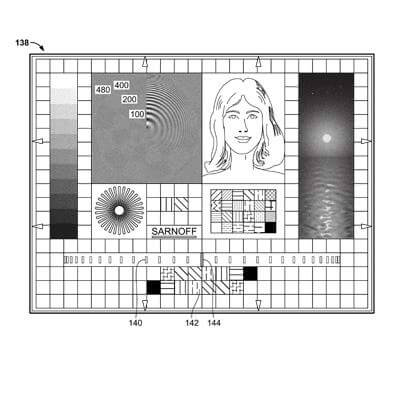

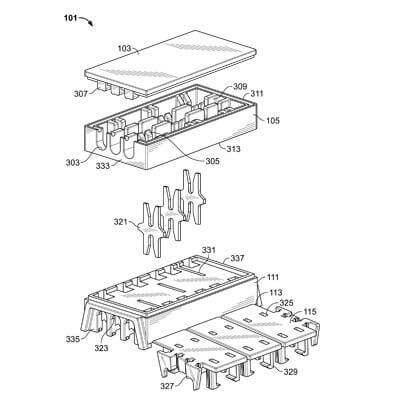

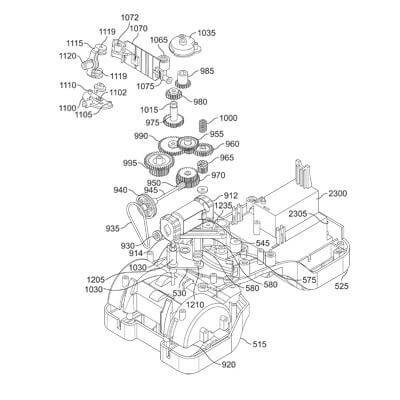

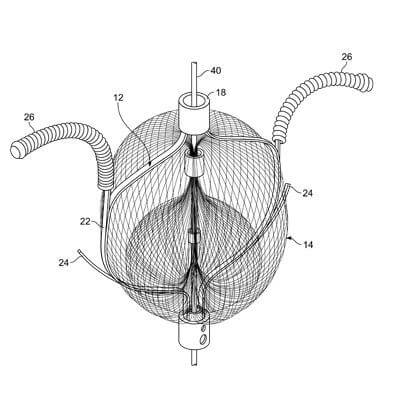

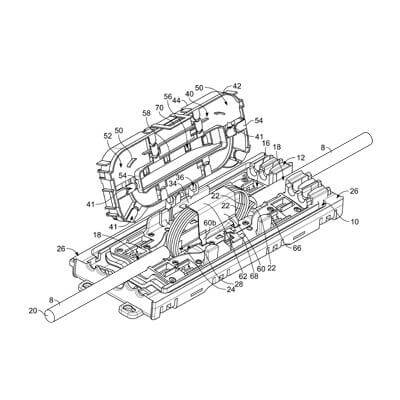

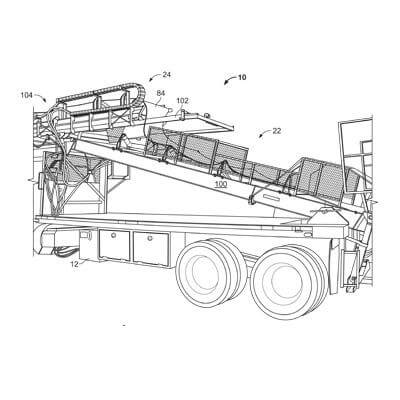

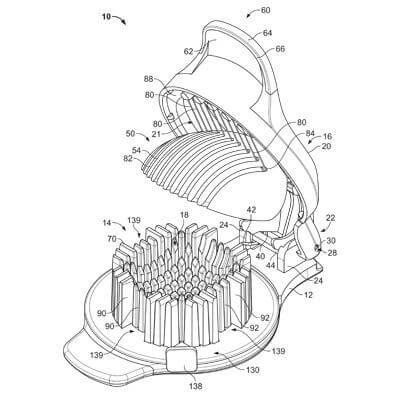

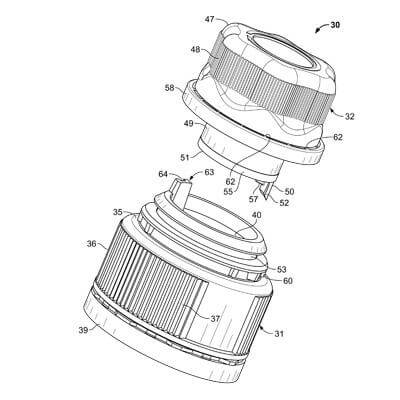

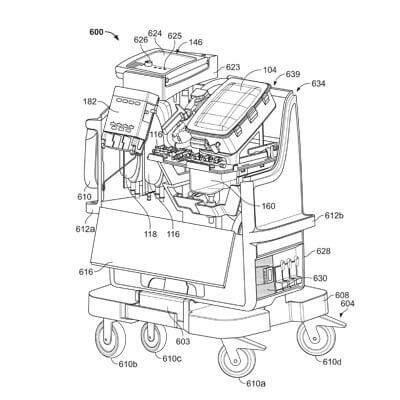

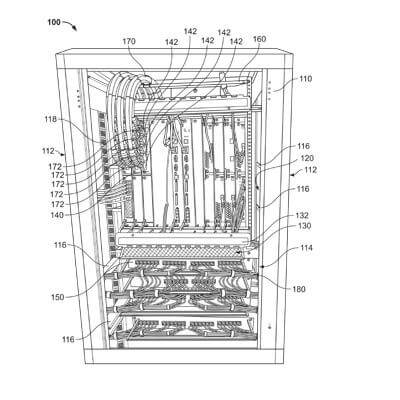

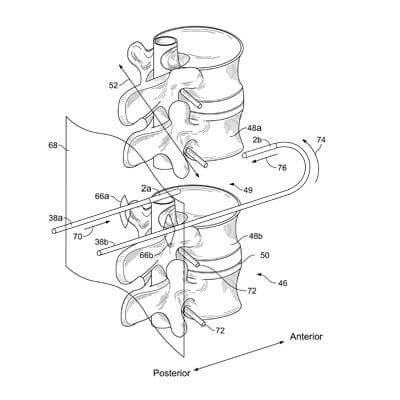

Patent/Trademark Illustrations

After 30,000 illustration projects, Legal Advantage LLC is committed to delivering the highest quality illustrations to most accurately represent complex patent designs and organic/graphic trademarks.

Patent Translation

With extensive knowledge of technical language and international IP standards, Legal Advantage LLC offers accurate and precise patent translations.